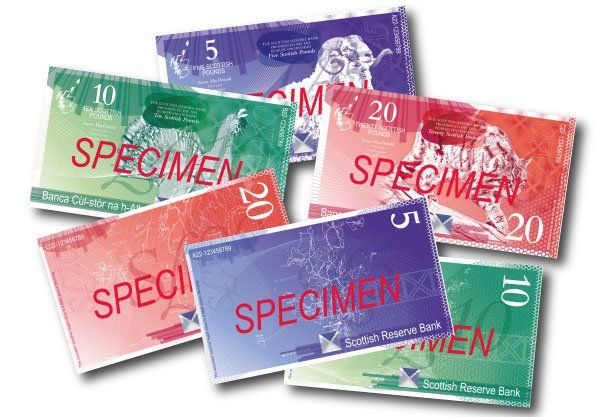

CURRENCY ROLLOUT

Customer Deposits (i.e., what is in your bank account)

You will be invited to exchange these into the S£ and put the proceeds into a new S£ account. The Scottish Reserve Bank (SRB) will issue the new S£ to your bank for onward transmission to your new bank account.

The SRB will buy your old sterling from your bank and keep it, pro-tem, in an account of its own at your bank. This has no effect on the sterling deposits of the bank as they have simply changed ownership and thus moved from one bank account to another within the same bank. At the S£ end of things, your bank now has a liability to you which is matched by an asset of the SRB deposit of the new S£ into your bank's reserve account with the SRB.

This is all totally voluntary and the default that will apply if you do nothing is that your sterling accounts stay as they are and you won't get a new S£ account.

Customer Loans (Mortgages, overdrafts, loans)

There will be no official action to force people to convert loans into the S£ but you will be encouraged and probably prodded to do so. Banks that wish to operate in Scotland will be required as part of their SRB Banking Licence to enable such conversion and to provide a full range of S£ products.

The best time to make a switch will be during the short temporary peg (maybe 6 weeks) after Currency Day as the rate is 1 to 1. If you delay the rate may be different and there will be FX fees to pay.

What is the process? Let us say you have an existing £100,000 mortgage. You ask to switch, so this is similar to a re-mortgage. Your bank will grant you a new S£100,000 mortgage on terms which will probably be similar unless e.g. your employment has changed. The bank simultaneously take the S£100k and converts it to £. That may be via the FX market, via the SRB or internally in the bank using money from other customers switching £ into S£. The £100k proceeds are used to pay off the old mortgage. At no point will you have two mortgages or find the S£100k available in your bank account.

On the sterling side, the bank will receive £100k (from an FX dealer, another customer, or the SRB) which it will use to clear your loan. That sterling is destroyed as always happens when a loan is settled. However there are more effects than just your loan being cleared. Your loan was an asset on the sterling balance sheet which is no longer there. There is not, though, any mismatch of assets and liabilities because the sterling that cleared your loan came from somewhere. It depends where it came from: If it came from the SRB then the SRB owned sterling account at your bank sees a fall in the deposit balance of £100k. If it came from another customer switching to S£, then it is a reduction of £100k in their deposit balance. If it came from an FX dealer then it is either a £100k fall in the dealer's deposits at the bank if the dealer has their account at this bank, or it is an addition of £100k to the bank's reserve account as it is transferred from another bank. So the assets and deposits on the sterling balance sheet remain matched and the balance sheet will have shrunk by £100k. The bank will see a steady reduction in the sterling balance sheet as the exchange proceeds and a corresponding increase in the S£ one.

To the extent that the SRB provides any sterling towards settling sterling loans,, then the Foreign Reserves of the SRB will be lower than they otherwise would have been from selling the new currency. Whether it does that or not depends on supply and demand in the market and thus the relative sizes of those switching cash into the S£ versus those switching cash out of the S£ to clear sterling debts. Overall there are thought to be around £150-200 billion of sterling available to eventually switch into the S£. 35% of households have a mortgage and those 900,000 mortgages are about £75 billion in total (per data provided to me by the House of Commons library). Personal loans, cards, etc are far less.

The Sterling Pension Guarantee

Anyone in receipt of a pension that is paid in sterling and resides in Scotland will be guaranteed the higher of the actual exchanged amount or the one to one S£ amount.

Strictly speaking, paying the UK state pension would be a UK liability if (which it has already clearly stated it will be) it is the Continuing State per the 1958 Vienna Convention. However as there is no actual pension fund other than money in transit in the National Insurance Fund (typically £15-20 billion – if there is more the Treasury helps itself to it) then I would expect that this is one of the few items where it would be fair and reasonable for ScotGov to take it over and it becomes the basis for the Scottish Pension. We would obviously also take 8% of whatever is in the National Insurance Fund (say £1.5 billion) which would tide things over for a month or two in case there are any problems with transferring National Insurance collection to Revenue Scotland and away from HMRC.

So those in receipt of a sterling pension would be from a rUK company scheme, an annuity (not from a Scottish provider) or a private pension (not from a Scottish provider). There would also be what would initially be a very small number of rUK state pension recipients who move to Scotland after Independence Day and would thus be in the same boat as anyone from the UK who currently lives in Spain.

If the S£ falls against sterling, as all the BritNats on Twitter so confidently predict, then the cost of the Guarantee is zero. Sterling pensioners are quids in because their sterling is worth more in terms of S£.

The only time there is a cost to the Guarantee is if the S£ rises against sterling. I would not want the S£ to rise against major currencies (S, Euro), but it may well be the case that sterling continues its century long decline due to Brexit devastation of the economy. In which case we would maybe see it fall a bit against the S£. Obviously a rising currency can be managed if you don’t want it to do so by simply spending more S£ into existence and / or the SRB selling it into the FX market.

So there could be a bit of cost to the Guarantee if sterling slumps, but precisely those conditions would mean ScotGov would have all sorts of options for paying the Guarantee cost. If you had to top up a million pensioners by £100 a month that would be £100 million per month. Trivial compared to the cost of reserves, etc., you might waste if you maintain a forced one-to-one peg against sterling to achieve the same ‘protection’. A peg would likely collapse one way or the other, and any funds lost go to speculators and not the pensioners. Iain Blackford MP proposed a ‘peg to protect pensioners’, but that is absolutely not the way to do it. If the aim is to protect pensioners, then protect those pensioners directly. Don’t try some indirect and uncertain method that could cause a lot of other issues and cost.